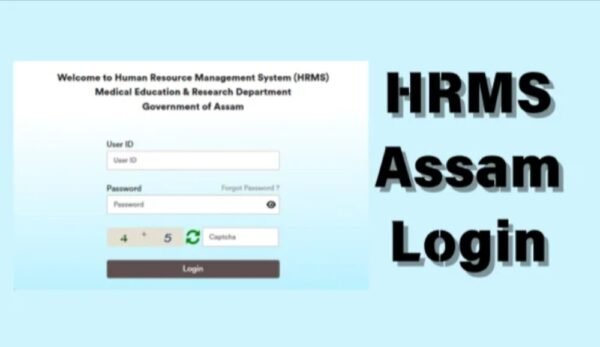

HRMS Solar Group Login: Employee Resource Platform complete Guide

In today’s rapidly changing workplace and workplace, digital HRMS systems (HRMS) are no longer a luxury but are essential. In public institutions as well as educational institutions or private businesses, HRMS portals ensure streamlined access to leaves, payslips schedules, records of employees. One such portal, catering to the employees of a large industrial firm includes Solar Group HRMS Portal. Solar Group HRMS Portal. If you’re looking to learn the process of using…