What is departmental accounting?

Simply put departmental accounting is an accounting system that involves the financial information of an organization, business or company is separated into different departments or divisions. This specific accounting technique is fairly commonplace but it’s not appropriate for every company or company. Why? You’ll learn more about it when you take a look at the benefits and drawbacks of departmental accounting. And this is exactly the topic we’re discussing this moment. So let’s start by examining the advantages and disadvantages of departmental accounting let’s get started, shall we?

Also Read: Top 10 nidhi companies in india 2024

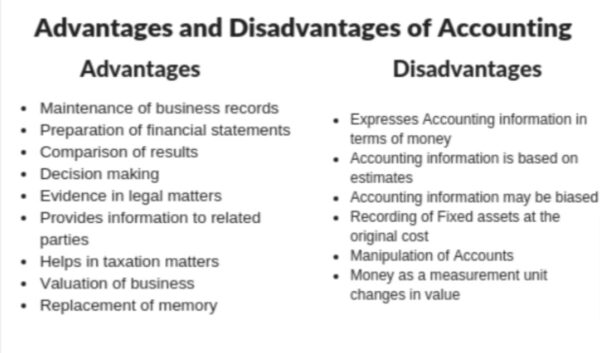

Advantages of Departmental Accounting

1. Better Decision-making

Departmental accounting is great because it aids in making wise decisions. If every department has its own set of books, also known as accounting, the person in charge can know what every part of the company is performing. This is vital in planning and allows you to earn additional money to the company or company and manage the business more efficiently.

2. Smarter Use of Resources

This type of account will certainly show management’s performance across every department, thereby allowing the allocation of resources to the appropriate locations. This means that whatever the department requires of will be accomplished completely, so that in reality, the department will increase its capacity as required and, in a similar way, ensure that the budget is in check to reduce the amount of waste.

3. More Accountability

In the process of keeping track of every department’s budgets separately means everyone’s task is more accountable. Naturally, this informs the people in charge who are doing great and need to do better. In this way, everyone in the control is aware that they must meet the established objectives because their activities are under close scrutiny.

4. Easier to Grow or Cut Back

Through departmental accounts, it’s easy to determine how to expand or close down a particular department based on the financial reports. The data will reveal what areas of the company are performing well and which aren’t. This will help the business determine the best place to put its money to get the most results.

5. Drawing in Investors

Investors generally prefer businesses that clearly state what they’re doing and how their funds are effectively managed. Departmental accounting will show how a specific part is performing, which makes it simple for investors to decide to invest in that specific business. The business that is able to demonstrate its departments are efficient and productive will, thus be in the best position to attract investments which are crucial to growth.

6. Boosting Competition

This accounting system could boost its competitiveness since it is a separate account for every department. It will incite everyone to try to do better than the other and thus increase the quantity or quality completed. This type of healthy competition may result in more innovative ideas and greater overall performance for the business.

Disadvantages of Departmental Accounting

1. Complexity and Management Difficulty

While it’s beneficial departmental accounting can make the financial aspect operating a firm complicated. This could become an absolute nightmare, as you have to keep multiple accounts for various departments, and looking into the inner workings within the departments. This added layer of complexity creates an increase in workload for accounting staff and makes audits a major difficult task.

2. Higher Costs

It is evident that you will need to spend a greater amount of money in order to set the departmental system of accounting. It’s a lot of money starting from training your staff to buying the appropriate software and then going through the effort to keep the department’s finances in order. If you’re a small-sized business it is possible that the cost may be excessive compared to the benefits and that’s the case in the end.

3. Risk of Poor Coordination

The fact that departments have the financial control themselves can be an obstacle to working together as a team since each department has their own way of doing things and it is difficult to move together in the same direction to achieve the objectives of the business. When it gets to the point of no coordination, an absence of coordination can lead to the same task being done often, or often at the very least. It could cause internal conflict which can make the processes within the company a chaos, or chaotic, to put it simply.

4. Data Security Concerns

In the departmental accounting situation the financial details for a greater amount of people will be increased which increases the chance of data leaks or misuse of data. If you’re already working on a tight budget and don’t have the funds to spend many dollars on accounting processes similar to smaller businesses that aren’t, it’s extremely difficult for them to think about the need to have additional security levels just to add to the expense and amount of work.

6. Resistance to Change

It is evident that the team will likely run into a roadblock when trying to bring in the roll-out of departmental accounting to a group which isn’t used to it. This is quite normal because this happens every when you introduce a new thing to the workplace. This isn’t necessarily a major disadvantage of departmental accounting, but rather something you can overcome.

Final Thoughts

Now you can probably understand why certain businesses or companies choose to follow the route of using departmental accounting and why some people avoid it. Right? And we hope this article has made it simpler for you to grasp the basics about this departmental accounting process.