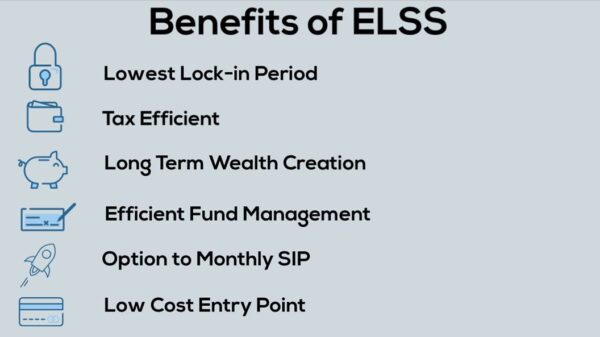

Equity investor adopts a cautious approach of not losing money in a stock market. On the other side of the coin, smart investors think about saving money and think about a long term horizon in mind. For an investor who is looking to saving tax ELSS seems to the best option. No need to step out as how to do cKyc online can be done by scanning your documents. Now let us explore the options why investing in ELSS funds is an attractive option

Tax benefit

First and foremost the major benefit of investing in ELSS is to save tax. Under section 80 C of the Income tax act you are entitled to a tax rebate of 1.5 lakhs. Any returns that you obtain from ELSS are free from tax as this would go a long way in reducing your tax liability.

Lock in period

In relation to the performance of mutual funds, a good mutual fund portfolio is designed keeping in mind your long term investment objectives. It is not bound with any lock in periods. In case of ELSS there is a stipulated lock in period of 3 years. This would mean that you are obliged to stay for 3 years or even more years to be exempt for tax returns. This fosters a good habit to be staying in an investment module for a long period of time.

Cash in on the long term growth

Though the standard protocol for ELSS funds to stay invested is for 3 years, you can continue it longer if the fund performs better. At the same time equity funds are subject to market risks. The objective of such funds is to invest in securities so higher returns on investment is assured with tax exemption.

Develops the habit of saving

The best part about an ELSS fund is that you can start investing with as low as RS 500. In due course of time your savings would turn on to investments. This culminates a habit of regularly investing. Since it is a 3 year investment after the end of this tenure in the first month the SIP amount is expected to be generated. In addition the returns are expected to be exempt from taxes.

While saving you can invest in equities

While investing in ELSS it allows you to avail the benefits of the growth cycle of stocks as part of your investment portfolio. Though savings is expected to provide you with 8 % returns on an annual basis, when you are investing in equities higher returns are expected. If the conditions are favourable it will help you avail higher returns in the stock market. This works out to be a benefit in a country like India where you need a good portfolio with quality stocks providing you with an opportunity of higher returns.

To sum it up, the main reason why people invest in ELSS funds is to avail tax rebates. But do not invest more than the deductible amount and opt for a diversified portfolio.